PDV is what the added value tax is called in Croatia (Value-added tax in the UK). This Croatian VAT is applied to most purchases of goods and services.

The purpose of PDV is to generate tax revenues for the national budget by taxing consumption.

The highest added value tax rate in Croatia is 25%. But there are goods that are taxed at lower rates including 13% and 5%.

Some activities are not subject to PDV in Croatia at all.

Croatia being an EU member state falls under the EU VAT scheme.

Short-Term Visit to the EU

If you visit a European Union country just as a tourist or for a business meeting, you may be eligible for a VAT refund of the VAT you pay during your stay in the EU.

Only receipts that charged the buyer more than 100 Euros qualify for a tax refund. Moreover, you can get a VAT reimbursement only for goods except for fuel.

A refund isn't applied to services either. Keep in mind that the purchased items must be transported outside of Croatia within 3 months of your buying them.

You can have a Croatian resident transport them on your behalf if you have already left the country.

PDV rates in Croatia

Below you'll find all categories and reduced rate categories of products, services, supply of goods, and their added value tax rates. If you want to dig deeper into PDV law on the internet, visit this website.

0% PDV

1. Some services of public importance

- Postal services

- Child and youth protection

- Private child and youth education

- Religious and spiritual services

- Activities carried out by non-governmental organisations

- Cultural services

- Sports services

- Patient transportation

- Public television and radio

- Hospital care

- Providing medical care and medicines

- Donating blood, breast milk, and human organs

- Dental fees

- Non-profit organisations transactions

- Social care

2. Some financial activities

- Insurance services

- Offering loans

- Stocks and bonds payments

- Management of investment funds

- Postal stamps

- Gambling

- Residential property rental

- Providing credit guarantees

- Giro transfers and current account transactions

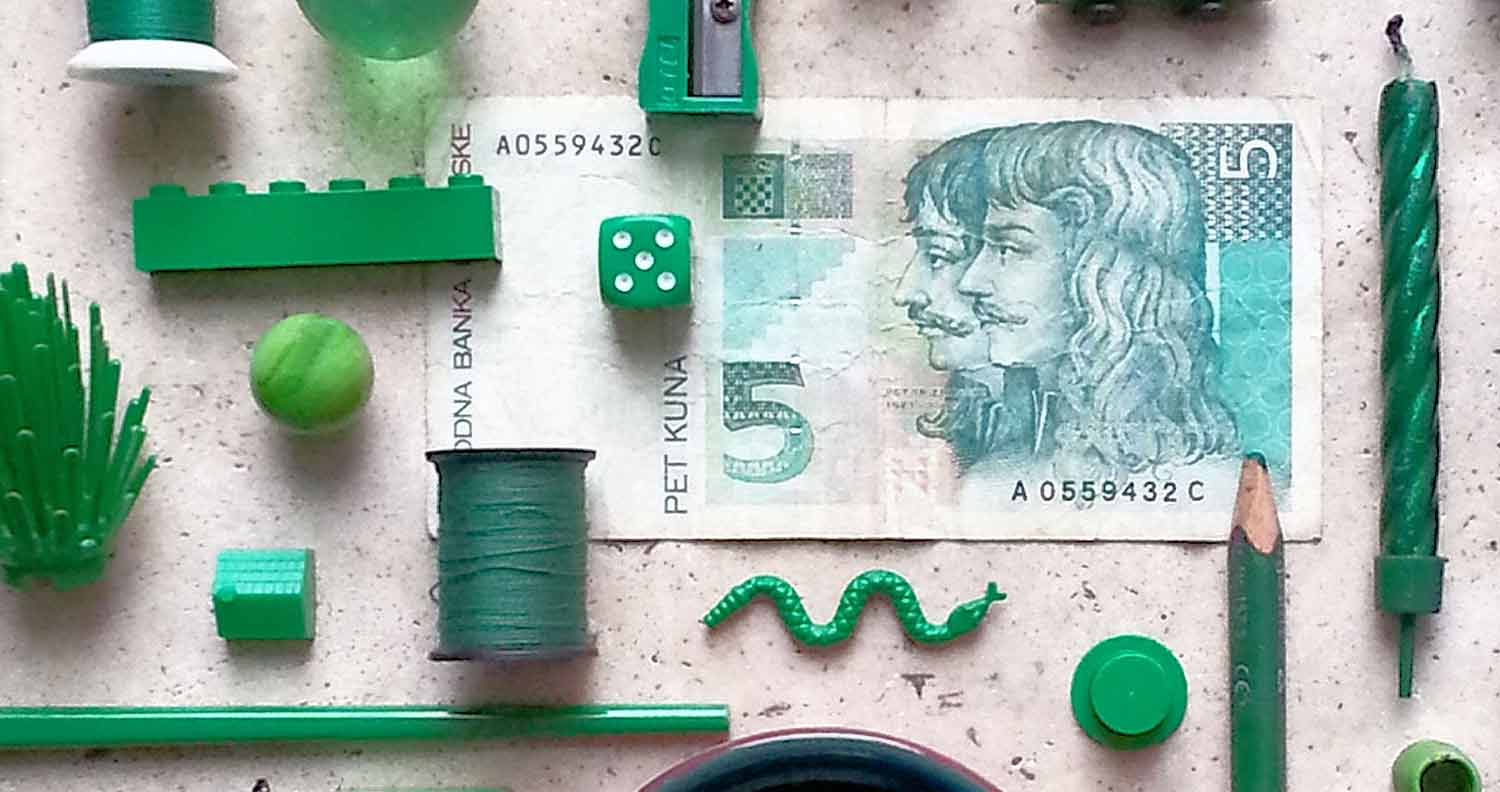

- Currency and banknote transactions

3. European Union Services

- Goods delivery

- Goods acquisition

- Some transportation services

4. Import of certain assets

5. Export of certain assets

6. International transport

7. Certain brokerage services

8. International trade transactions

5% PDV

- Breast milk substitutes and baby food

- Butter and margarine

- Types of Bread and rolls

- Types of Milk in liquid form originating from cows, goats, sheep

- Meat and live fish delivery

- Egg delivery

- Fresh fruits and vegetables

- Fertilizers

- Medications

- Medical products that are introduced into the human body via surgery

- Daily newspapers excluding those that contain advertisements

- Tickets for sports and cultural events

- Cinema Tickets

13% PDV

- Accommodation services

- Baby car seats

- Baby diapers

- Water, electricity, and gas delivery

- Communal services

- Live animal delivery

- Frozen fish and vegetables

- Dried fruits

- Copywrite services

- Science journals

25% PDV

Any other goods and services are subject to a standard tax rate of 25%.

Read this next: Our How-To Guide for Tipping in Croatia

How PDV is charged?

The amount of tax must be specified on every receipt or invoice of a taxable product or service. Make sure to look for this detail when buying.

PDV is mandatory only for businesses that have revenue that exceeds the 300,000 HRK (40,000 Euro) per year threshold.

If your annual revenue is lower, you decide whether or not to pay the consumption tax.

If you don't want to register with the PDV system, you will not be able to introduce an added value tax on your products and get a tax reimbursement.

If you voluntarily join the PDV system, your membership should last for at least 3 years.

However, you are obliged to stay in only if your revenue is higher than 40,000 Euro per year.

Sometimes you may have to enter the PDV system because your revenue has exceeded 40,000 Euro in one year.

If in the next year, your business generates a lower revenue, you are free to interrupt your obligations for paying the PDV and you won't get punished for that.

How PDV for imports is applied?

If you move from another country to Croatia, you are exempted from paying the VAT for the personal goods you pass over the Croatian border.

That is, all household items you intend to bring into Croatia upon your relocation from abroad, including furniture, clothing, appliances, jewelry, basic tools, and children's toys are free of taxation according to the customs legislation.

But of course, you have to provide details about your relocation, such as your residence address in Croatia, a property purchase contract, or a confirmation from a foreign or Croatian employer.

Moreover, you have to send a request for tax exemption to the customs office. If your request is approved, you have 12 months (from the day you move to Croatia) to import your personal belongings.

You have, though, to pay the VAT when importing certain items that don't fall into the category of household goods.

It can be a car, tobacco products, alcohol, commercial passenger vehicles, industrial machinery, and tools.

The tools category might be tricky as there are tools considered household items such as pliers, chainsaws, and lawnmowers.

They are not subject to VAT when crossing the Croatian border. Tools that are used for industrial purposes by members of a profession are taxable.

VAT in other countries

VAT registration and VAT is a taxation system used in most countries around the world. Each nation calls it in its own way.

- Turkey has KDV

- Australia it's GST (Goods and Services Tax), the

- Brazil's equivalent of VAT is ICMS.

- United Kingdom: VAT

- Spain: IVA

VAT Rates Globally

Each country has its own VAT rate. Croatia has one of the highest standard VAT rates. A higher rate is set only by Iceland which is 25,5%. In Sweden and Denmark VAT is also 25%.

Egypt carries the added value tax to 14% while Canada to 5%.

Countries like Qatar, Kuwait, and Brunei don't have a VAT tax.

The USA doesn't have one either, but they replace it with Sales Tax. While VAT is collected by each link in the supply chain (manufacturers, distributors, etc), sales tax is applied only upon the purchase of a good by the final consumer.

Croatia VAT Exceptions

Checking VAT ID When selling to a customer in Croatia, ask for their VAT ID (PDV-ID).

Most businesses have one, but end-consumers don't.

Verify VAT ID to avoid fake IDs submitted by customers trying to avoid VAT charges.

Use VAT number check during online payment to validate automatically.

If the customer holds a valid VAT ID, you're exempt from charging VAT for intra-community (EU) & cross-border (international) supplies.

A reverse charge mechanism applies, where the buyer is responsible for filing VAT on the transaction.

Read this next: On a Budget? These Hostels in Novalja May be Perfect for You!

PDV in Croatia: Summary

PDV in Croatia is the abbreviation for "porez na dodanu vrijednost" in Croatian, which translates to "value-added tax" in English.

It is a tax applied to goods and services in Croatia, similar to VAT in other countries.

It can get a little complicated so if you find yourself struggling we would advise you to seek professional advice.